The Complete Guide to Compound Interest: Einstein's Eighth Wonder of the World

Compound interest is the most powerful force in the universe when it comes to building wealth—but only if you understand how to harness it effectively.

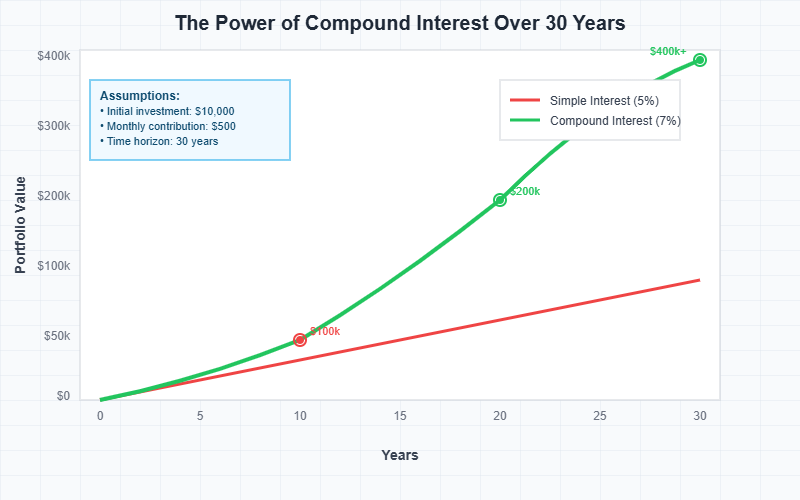

Chart showing exponential growth of compound interest over 30 years

The exponential power of compound interest: Your money working for you 24/7.

Chart showing exponential growth of compound interest over 30 years

The exponential power of compound interest: Your money working for you 24/7.

The $1 Million Mistake Most People Make

Meet Sarah and Mike: Two friends, both age 25, both earning $50,000 annually. Sarah invests $2,000 per year for just 10 years (ages 25-35), then stops. Mike waits until age 35 to start investing $2,000 per year for 30 years until retirement.

The shocking result at age 65:

- Sarah's total: $602,070 (invested only $20,000)

- Mike's total: $566,416 (invested $60,000)

Sarah invested $40,000 less but ended up with $35,654 more. That's the power of compound interest—and why timing matters more than the amount.

The Simple Definition

Compound interest is "interest earned on interest." When your investments earn returns, those returns start earning their own returns, creating an exponential snowball effect.

Simple vs. Compound Interest: The Big Difference

Simple Interest Example: $1,000 at 10% for 5 years = $1,000 + ($100 × 5) = $1,500

Compound Interest Example: $1,000 at 10% for 5 years = $1,610.51

That extra $110.51 might seem small, but over decades, it becomes millions.

The Compound Interest Formula

A = P(1 + r/n)^(nt)

Where:

- A = Final amount

- P = Principal (initial investment)

- r = Annual interest rate (as a decimal)

- n = Number of times interest compounds per year

- t = Time in years

For monthly contributions: FV = PMT × [((1 + r)^n - 1) / r]

Where:

- FV = Future value

- PMT = Monthly payment

- r = Monthly interest rate

- n = Total number of payments

The Rule of 72

Quick calculation: Divide 72 by your annual return to see how long it takes to double your money.

- 7% return: Money doubles every 10.3 years

- 8% return: Money doubles every 9 years

- 10% return: Money doubles every 7.2 years

The Three Variables That Matter Most

1. Time (The Most Important Factor)

- Starting 10 years earlier can result in 2-3x more wealth

- Time is more important than the amount invested

- You can't make up for lost time with bigger contributions

2. Rate of Return

- 2% difference in returns = 50%+ difference in final wealth

- Focus on low-cost investments to maximize net returns

- Consistency beats perfection

3. Contribution Frequency

- Monthly investing beats annual investing

- Dollar-cost averaging reduces risk

- Automatic investing ensures consistency

The Exponential Curve

Years 1-10: Slow, steady growth (feels disappointing) Years 11-20: Accelerating growth (gets exciting) Years 21-30: Explosive growth (becomes life-changing)

This is why most people quit too early—they don't see the exponential phase.

The Coffee Shop Investment

Scenario: Instead of buying a $5 coffee daily, invest that money.

- Daily coffee: $5 × 365 = $1,825/year

- Invested at 7% for 30 years: $184,550

- Total invested: $54,750

- Interest earned: $129,800

Your daily coffee habit could be worth $184,550 in retirement.

The Early Bird vs. The Procrastinator

Early Bird (Emma):

- Starts investing at age 22

- Invests $3,000/year for 8 years (total: $24,000)

- Stops investing at age 30, lets it grow

- Balance at 65: $565,000

Procrastinator (Paul):

- Starts investing at age 30

- Invests $3,000/year for 35 years (total: $105,000)

- Balance at 65: $540,000

Emma invested $81,000 less but ended up with $25,000 more.

The Millionaire Math

How to become a millionaire with compound interest:

Option 1: The Aggressive Saver

- Start at 25, invest $500/month

- 7% annual return

- Millionaire by age 57

Option 2: The Steady Eddie

- Start at 25, invest $300/month

- 7% annual return

- Millionaire by age 62

Option 3: The Late Starter

- Start at 35, invest $800/month

- 7% annual return

- Millionaire by age 65

The Retirement Reality Check

What different savings rates mean for retirement:

| Monthly Investment | Starting Age | Balance at 65 |

|---|---|---|

| $200 | 25 | $525,000 |

| $500 | 25 | $1,312,000 |

| $1,000 | 25 | $2,624,000 |

| $200 | 35 | $245,000 |

| $500 | 35 | $612,000 |

| $1,000 | 35 | $1,224,000 |

Assumes 7% annual return

Strategy 1: Start Immediately

The best time to start was 20 years ago. The second best time is now.

- Don't wait for the "perfect" amount

- Start with $25, $50, or $100/month

- Focus on building the habit first

Strategy 2: Increase Contribution Frequency

Why monthly beats annual investing:

- Monthly: More time in market for each contribution

- Dollar-cost averaging reduces risk

- Easier on your budget

Example over 20 years:

- Annual $6,000 investment: $245,973

- Monthly $500 investment: $247,115

- Difference: $1,142 (small but free)

Strategy 3: Reinvest Everything

The compound interest killer: Taking profits early

- Reinvest all dividends and interest

- Avoid lifestyle inflation when investments grow

- Think of your portfolio as a money-making machine

Strategy 4: Optimize Your Tax Strategy

Tax-advantaged accounts supercharge compound interest:

Traditional 401(k)/IRA:

- Immediate tax deduction

- Tax-deferred growth

- Pay taxes in retirement

Roth 401(k)/IRA:

- No immediate tax deduction

- Tax-free growth forever

- No taxes in retirement

Example: $6,000/year for 30 years

- Taxable account: ~$566,000 (after taxes)

- Tax-advantaged account: ~$612,000

- Tax savings: $46,000+

Strategy 5: Keep Costs Low

How fees destroy compound interest:

High-fee mutual fund (1.5% annual fee):

- $500/month for 30 years

- Gross return: 7%

- Net return: 5.5%

- Final balance: $461,000

Low-cost index fund (0.03% annual fee):

- Same investments

- Net return: 6.97%

- Final balance: $610,000

- Difference: $149,000

Mistake 1: Waiting for the "Right Time"

Problem: Trying to time the market or waiting for more money Solution: Start now with any amount you can afford

Cost of waiting just 5 years:

- Starting at 25: $612,000 at retirement

- Starting at 30: $422,000 at retirement

- Cost of waiting: $190,000

Mistake 2: Not Understanding Risk vs. Time

Problem: Being too conservative when young Solution: Age-appropriate risk allocation

Conservative portfolio (25-year-old):

- 40% stocks, 60% bonds

- Expected return: 5%

- 40 years of $300/month: $458,000

Aggressive portfolio (25-year-old):

- 90% stocks, 10% bonds

- Expected return: 8%

- 40 years of $300/month: $933,000

- Difference: $475,000

Mistake 3: Panicking During Market Downturns

The biggest compound interest killer: Selling during crashes

Historical example:

- Investor A: Stayed invested through 2008 crash

- Investor B: Sold during crash, waited 2 years to reinvest

- 10-year difference: 40%+ less wealth for Investor B

Mistake 4: Not Automating Investments

Problem: Relying on willpower to invest Solution: Automatic investing

Automatic investor:

- Invests $300/month consistently

- Never misses a month

- Total after 30 years: $367,000

Manual investor:

- Misses 2 months per year on average

- Effective investment: $250/month

- Total after 30 years: $306,000

- Cost of inconsistency: $61,000

Mistake 5: Lifestyle Inflation

Problem: Increasing spending instead of saving when income grows Solution: Increase investments with income

Lifestyle inflator:

- Always saves 10% regardless of income

- Income grows from $50K to $100K over 20 years

- Total saved: $1.5 million

Wealth builder:

- Starts saving 10%, increases to 20% as income grows

- Same income progression

- Total saved: $2.1 million

- Difference: $600,000

Stock Market Investments

Index Funds (Recommended for Most People)

- Expected return: 7-10% annually

- Low cost (0.03-0.20% fees)

- Instant diversification

- Examples: S&P 500, Total Stock Market

Individual Stocks (For Experienced Investors)

- Potential for higher returns

- Higher risk and volatility

- Requires research and monitoring

- Can achieve 10%+ returns with skill/luck

Real Estate

REITs (Real Estate Investment Trusts)

- Expected return: 6-10% annually

- Professional management

- Instant diversification

- Liquid (can sell anytime)

Direct Real Estate Ownership

- Expected return: 8-12% annually

- Tax advantages

- Leverage opportunities

- Requires active management

High-Yield Savings and CDs

High-Yield Savings Accounts

- Expected return: 2-5% annually

- FDIC insured (safe)

- Liquid (accessible anytime)

- Good for emergency funds

Certificates of Deposit (CDs)

- Expected return: 3-6% annually

- FDIC insured

- Fixed terms (penalty for early withdrawal)

- Good for conservative investors

Retirement Accounts

Why retirement accounts are compound interest superstars:

- Tax advantages amplify returns

- Forced long-term investing

- Higher contribution limits

- Protection from early withdrawal temptation

Why Most People Fail at Compound Interest

1. Impatience

- Compound interest starts slowly

- Most dramatic growth happens in later years

- People quit before seeing exponential phase

2. Instant Gratification Bias

- $500 today feels more valuable than $5,000 in 30 years

- Difficulty visualizing future wealth

- Temptation to spend instead of invest

3. Loss Aversion

- Fear of losing money prevents starting

- Overreaction to market volatility

- Selling at worst possible times

Mental Models for Success

1. The Tree Analogy

- Planting seeds (early investments) grows mighty trees (wealth)

- Don't keep digging up the seeds to check growth

- The longer you wait to plant, the smaller your forest

2. The Snowball Effect

- Compound interest is like rolling a snowball downhill

- Starts small but becomes unstoppable

- The steeper the hill (higher returns), the faster it grows

3. The Employee Mindset

- Think of your money as employees working for you

- Each dollar invested is hiring a worker

- These workers never take breaks, never get sick, never quit

Building Compound Interest Habits

1. Make It Automatic

- Set up automatic transfers on payday

- "Pay yourself first" before expenses

- Remove the decision-making from investing

2. Visualize Your Future

- Use compound interest calculators regularly

- Set specific financial goals with timelines

- Create vision boards of your financial future

3. Track Your Progress

- Monitor your net worth monthly

- Celebrate milestones ($10K, $50K, $100K)

- Focus on the trend, not daily fluctuations

The Bucket Strategy

Organize investments by time horizon:

Bucket 1: Short-term (0-5 years)

- High-yield savings

- Short-term CDs

- Money market funds

- Goal: Preserve capital

Bucket 2: Medium-term (5-15 years)

- Balanced funds (60% stocks, 40% bonds)

- Target-date funds

- Conservative portfolios

- Goal: Moderate growth with stability

Bucket 3: Long-term (15+ years)

- Aggressive stock portfolios

- Growth stocks and funds

- International investments

- Goal: Maximum compound growth

Geographic Arbitrage

Maximize your purchasing power:

- Earn high-income city salaries

- Live in lower-cost areas (remote work)

- Invest the difference

- Retire in low-cost countries

Example:

- Save $2,000/month extra through arbitrage

- Invest for 20 years at 7%

- Additional wealth: $982,000

The Roth Conversion Ladder

Advanced tax strategy:

- Convert traditional IRA funds to Roth during low-income years

- Pay taxes now at lower rates

- Enjoy tax-free compound growth forever

- Particularly powerful for early retirees

Asset Location Strategy

Optimize taxes by account type:

Taxable accounts:

- Tax-efficient index funds

- Individual stocks (for tax-loss harvesting)

- Municipal bonds (if in high tax bracket)

Tax-deferred accounts (401k, Traditional IRA):

- Bonds and bond funds

- REITs

- High-turnover investments

Tax-free accounts (Roth):

- Highest-growth investments

- Small-cap stocks

- Emerging market funds

Week 1: Foundation Building

Day 1-2: Assess Your Current Situation

- Calculate your current net worth

- Determine how much you can invest monthly

- Review your current investment accounts

Day 3-4: Set Up Automatic Investing

- Open investment accounts if needed

- Set up automatic transfers from checking

- Choose your initial investments

Day 5-7: Educate Yourself

- Use compound interest calculators

- Read about index fund investing

- Understand the power of time in market

Month 1: Building Momentum

Week 1:

- Make your first investment

- Set up automatic monthly contributions

- Track your starting point

Week 2-4:

- Resist the urge to check accounts daily

- Focus on increasing income or reducing expenses

- Learn about tax-advantaged accounts

Months 2-6: Optimization

- Increase investment amount if possible

- Optimize your investment mix

- Consider additional investment accounts

- Review and rebalance quarterly

Year 1 and Beyond: Staying the Course

- Increase investments with salary raises

- Rebalance annually

- Stay educated about investing

- Never stop the compound interest machine

Quick Start Options by Income Level

Income $30,000-50,000:

- Start: $100-200/month

- Accounts: Roth IRA, then 401(k) to match

- Investments: Target-date fund

Income $50,000-100,000:

- Start: $300-500/month

- Accounts: 401(k) to match, max Roth IRA

- Investments: Three-fund portfolio

Income $100,000+:

- Start: $800+/month

- Accounts: Max 401(k), backdoor Roth IRA

- Investments: Advanced asset allocation

From Consumer to Investor

Old mindset: "I can't afford to invest" New mindset: "I can't afford NOT to invest"

Old mindset: "I'll start investing when I earn more" New mindset: "I'll start investing to earn more"

Old mindset: "Investing is risky" New mindset: "Not investing is the biggest risk"

The Wealth-Building Timeline

Years 1-5: The Foundation

- Building habits and discipline

- Learning about investing

- Small but growing account balances

Years 6-15: The Acceleration

- Compound interest becomes noticeable

- Investment knowledge grows

- Multiple income streams develop

Years 16-25: The Momentum

- Portfolio growth outpaces contributions

- Passive income becomes significant

- Financial independence within reach

Years 25+: The Freedom

- Compound interest creates life-changing wealth

- Work becomes optional

- Financial legacy secured

Final Thoughts: Your Compound Interest Legacy

Compound interest isn't just about money—it's about freedom. Freedom from financial stress, freedom to pursue your passions, freedom to help others, and freedom to live life on your terms.

The choices you make today with compound interest will determine whether you're working until 65+ or retiring early, whether you're stressed about money or secure in your financial future, whether you leave a legacy or leave debt.

Remember: Every dollar you invest today is worth approximately $10-15 in 30 years. Every month you delay investing costs you thousands in future wealth. Every year you wait makes financial independence that much harder to achieve.

The magic of compound interest starts with a single decision: the decision to begin.

Take Action Today

Ready to harness the power of compound interest? Here are your next steps:

- Calculate your compound interest potential with our Compound Interest Calculator

- Learn the basics of investing with our Complete Beginner's Investment Guide

- Maximize your 20s wealth building with our Wealth Building in Your 20s Guide

- Plan for the long term with our Retirement Planning Guide

Remember: The best time to plant a tree was 20 years ago. The second best time is now. Your future self will thank you for starting today.

This guide is for educational purposes only and not personalized financial advice. Consider your individual situation and consult with financial professionals for specific guidance.

🎯Key Takeaways

- Time is your most powerful wealth-building tool - Start investing now, even with small amounts

- Consistency beats perfection - Regular monthly investing outperforms trying to time the market

- Keep costs low - High fees are compound interest killers

- Stay invested through downturns - Market volatility is temporary, compound growth is permanent

- Automate everything - Remove emotions and decision-making from investing

- Increase investments with income - Avoid lifestyle inflation trap

- Use tax-advantaged accounts - Maximize the power of compound growth

- Focus on the long term - Think decades, not months or years

✅Start Your Investment Journey Today

Take the first step toward building wealth with our comprehensive investment guides and resources.

Explore Investment Options